SUPERANNUATION

In many cases your superannuation account will be your largest asset after your home, because of this shouldn’t you decide where it is invested? You are able to choose which superannuation fund your compulsory superannuation guarantee payments are made into, and this is known as ‘Choice of Super Fund’.

When was Choice of Fund introduced?

Choice of fund was introduced on 1 July 2005, and was expanded on 1 July 2006 to include employees working under State Awards.

Who is covered by Choice of Fund?

You can choose which superannuation fund you would like your contributions paid into if you are:

Employed under a federal award,

Employed under a former state award, now known as a ‘notional agreement preserving state award’,

Employed under another award or agreement that doesn’t require superannuation support, or

Not employed under any state award or industrial agreement (including contractors paid principally

for their labour).

Who is not covered by Choice of Fund?

You may not be able to choose which superannuation fund you would like your contributions paid into if you are:

Paid superannuation under a state award or industrial agreement or under certain workplace agreements, including an Australian Workplace Agreement (AWA) and collective agreements (although choice can also be provided under these awards or agreements),

In a particular type of defined benefit fund or you have already reached a certain level in a defined benefit fund, or

Some federal and state public sector employees are also excluded from choice of superannuation. If you would like help determining if you are eligible for Super Choice please speak to your financial

adviser or employer.

How do I let my employer know I have chosen a fund?

You need to provide your employer with a completed and signed “Standard Choice Form”.

When you start work with a new employer they should provide you with this form if you are eligible for Super Choice. Once you have correctly completed and submitted the form your employer then has two months to start paying your contributions into your nominated fund.

You are able to change your superannuation fund as often as you wish, however your employer is only legally required to accept one change every twelve months.

What happens if I don’t choose a fund?

Your employer will have an “employer nominated fund” also known as a “default fund”. If you do not nominate an alternative fund, then your contributions will be paid into this fund.

The employer nominated fund must be a complying superannuation fund, and must also offer you a minimum level of insurance as discussed below.

Minimum insurance cover

The insurance cover must comply with the following requirements:

A premium of at least $0.50 per week for those under 56 years of age, or

The level of insurance cover must equal or exceed that shown in the table below, or

If the contributions are made to a defined benefit fund on behalf of a defined benefit member, the cover must equal or exceed that detailed in the table below.

COMPULSORY SUPERANNUATION GUARANTEE PAYMENTS

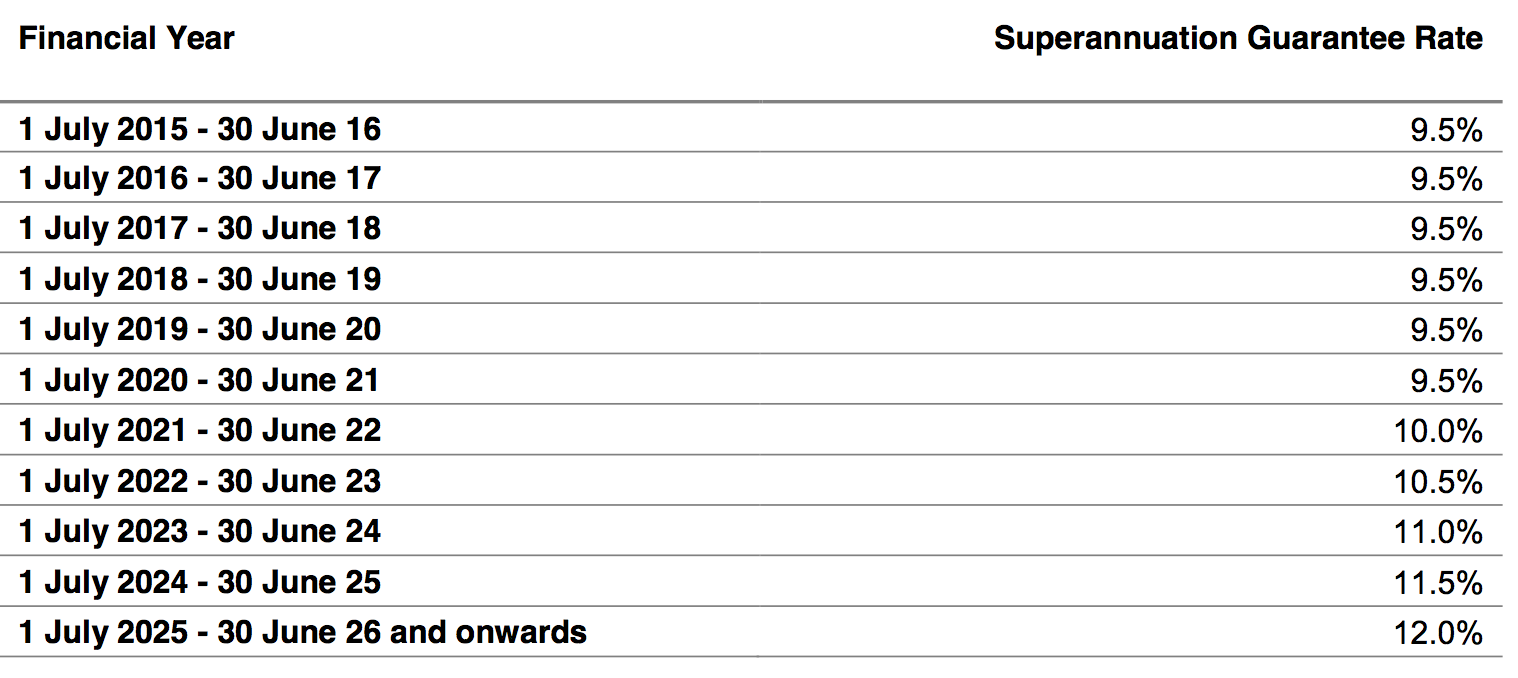

As an eligible employee, you are also entitled to compulsory superannuation contributions from your employer. The percentage that your employer is obligated to contribute on your behalf each financial year is detailed in the following table:

There is now no upper age limit for making superannuation guarantee contributions for an employee. This also means that eligible employees over the age of 70 can now receive superannuation guarantee contributions until you decide to retire.

MySuper

If you have not made a choice of fund, your employer will be obligated to commence paying your compulsory superannuation guarantee contributions to a superannuation fund that offers a MySuper product.

A MySuper product is a new, simple and cost-effective superannuation product that will offer a standard set of features and fees. For more guidance in this area please speak to your financial adviser.